Following the Paris Agreement, global energy transition scenarios have been presented. While these tend to be analysed in terms of gross energy, precise accounting requires assessing net energy. To this end, the notion of ‘energy return on investment’ (EROI) is useful. It signifies the amount of useful energy yielded from investing a unit of energy into obtaining that energy. Coal and hydroelectricity have high, nuclear, oil and gas medium, and solar and wind power medium to low EROIs.

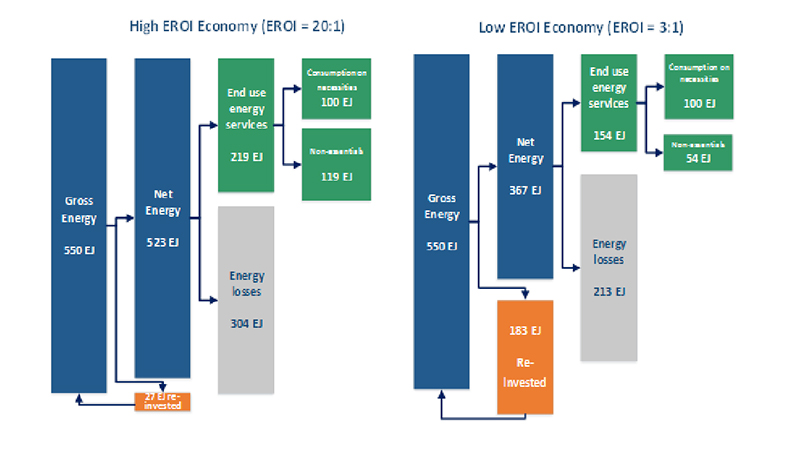

The importance of low versus high EROI energy sources for the economy, welfare and lifestyles is illustrated in the scheme. To improve lifestyles, the low-EROI society has three options: increase gross energy production, improve end use energy efficiency in production and consumption of goods/services, or improve average EROI considerably through technological improvements and investment in higher-EROI energy sources.

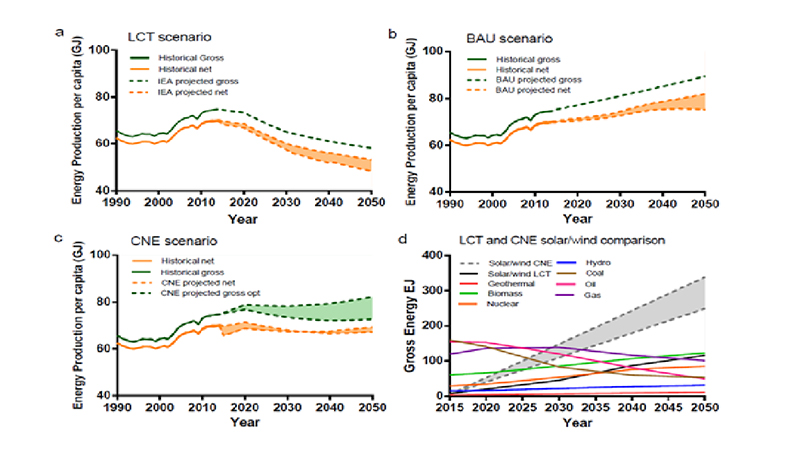

We develop a dynamic model to analyse net energy supplied to society, considering operational and investment costs. The model is used to undertake three exercises: (1) simulate a low-carbon transition consistent with >66% probability of limiting warming to 2°C, using a basic scenario of the International Energy Agency as a reference; (2) simulate a ‘business as usual´ scenario based on current trends; and (3) optimise a transition to maintain current levels of net energy per capita by maximizing net energy within the 2°C carbon budget.

The findings (see graphs) indicate that without substantial investments in energy efficiency, net energy per capita is likely to decline in the future between 24% and 31% from 2014 levels. To maintain current net energy per capita, renewable energy sources would have to grow at a rate 2-3 times that of current projections. The results further indicate a prioritization in phasing out fossil fuels, namely first coal then oil and finally gas. This can be achieved by implementing a carbon price, as it discourages coal more than oil, and oil more than gas. Finally, we propose an ‘energy return on carbon’ (EROC) indicator, a metric of net energy per tCO2, to assist in maximizing net energy within the 2 ºC carbon budget.

Reference